Closing the ROI Divide: Revealing the Economic Impact of ABM

As we usher in 2024, the spotlight is on ROI.

B2B marketers are gearing up to align their strategies with a revenue-driven agenda. The challenge lies in quantifying the impact of every marketing action, and presenting the numbers that prove the influence of these activities.

Decoding ROI: Aligning CMO-CFO Objectives

As organizations engage in year-end budget discussions, the intricate dance between CMO objectives and CFO expectations becomes increasingly apparent. In the B2B realm the challenge of attributing marketing ROI is heightened due to the complex nature of B2B journeys – multiple individuals from the buying group engaging through numerous channels. Moreover, most B2B journeys are conducted anonymously, and marketers cannot identify individuals by their account and/or email…

However, the key to overcoming this challenge lies in speaking a common language with the CFO – evaluating the economic impact of marketing activities.

Four Steps to Measure ABM’s Economic Impact

In ABM, a key objective is to elevate engagement with the Ideal Customer Profile (ICP) buying group, steering them toward paths that result in closed-won deals. But how can we measure that progress? What could be some relevant KPIs? Here is an overview of how we look at the economic impact of the website:

- Focus on Company Visits, Not Individuals: Shift from tracking individual visits to monitoring company-level engagements for more impactful metrics.

- Link Visiting Companies to Deals: Correlate company visits with CRM pipeline opportunities to gain an economic viewpoint.

- Calculate Economic Metrics: Use metrics like Deal Conversion Rate to evaluate the economic impact of website content and other assets.

- Assess Revenue Impact: Extend analysis to closed-won deals to understand their contribution to revenue.

Adopting an economic perspective enables us to engage more effectively with financial leaders, explaining the effects of certain marketing initiatives in language they understand. This approach, grounded in accountability and maturity for quantifiable economic outcomes, also earns us greater credibility for investing in initiatives that are not directly measurable in economic terms, such as awareness campaigns, dark social, brand development, and similar areas.

Using Trendemon to Evaluate Economic Impact

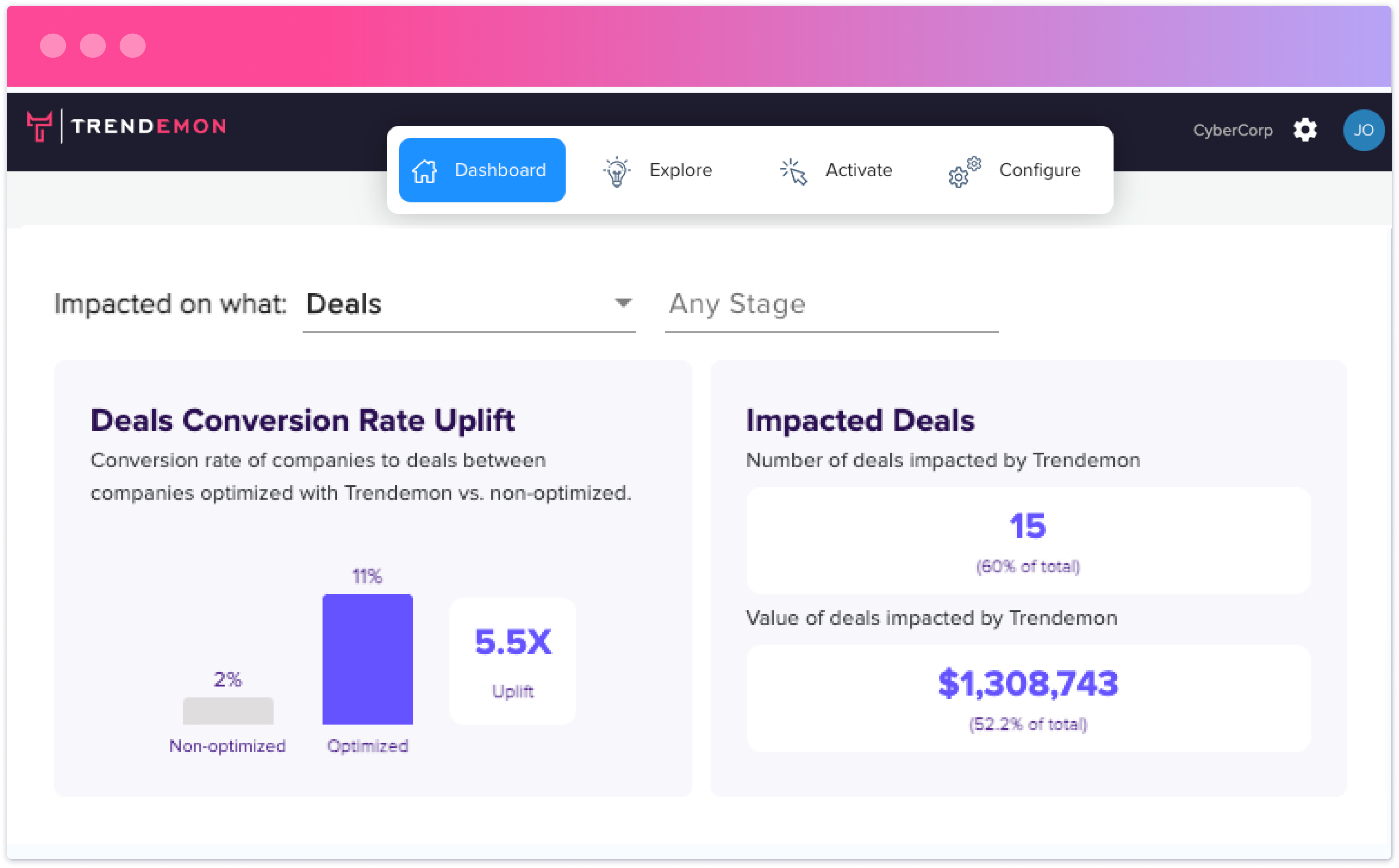

Just as assets and activities need to be financially justified, so do technologies. At Trendemon, we recognize the significance of justifying tool costs, prompting us to enhance our Salesforce integration and develop a comprehensive measuring methodology.

Our system provides answers to pivotal questions, including:

- What is the impact and uplift of personalization on successful deals?

- Which content pages significantly influence deals, their dollar value, and stages?

- How do different traffic sources, channels, and campaigns contribute to closed-won deals and pipelines?

Now, you can compare various marketing activities and see how they affect your pipeline. This helps you figure out what might have occurred if you didn’t take these actions and evaluate their marginal impact. For instance, consider a LinkedIn campaign that drove a certain amount of deal values to your website. How much of these dollars would have still come to your website (maybe organically) even if you hadn’t run this paid campaign?

Evaluating 6sense Audience Performance Using This Framework

Explore our recent blog post delving into the economic analysis of 6sense segments: “How Conversion Rates of 6sense Audiences Compare with Other Segments?”. In this analysis, we compare deal conversion rates of different audiences and evaluate the uplift of 6sense and Trendemon in closed-won deals.